is there a death tax in texas

The estate tax sometimes referred to as the death tax is a tax levied on the estate of a recently deceased person before the money passes on to their heirs. Death Tax In Texas.

Texas Inheritance Laws What You Should Know Smartasset

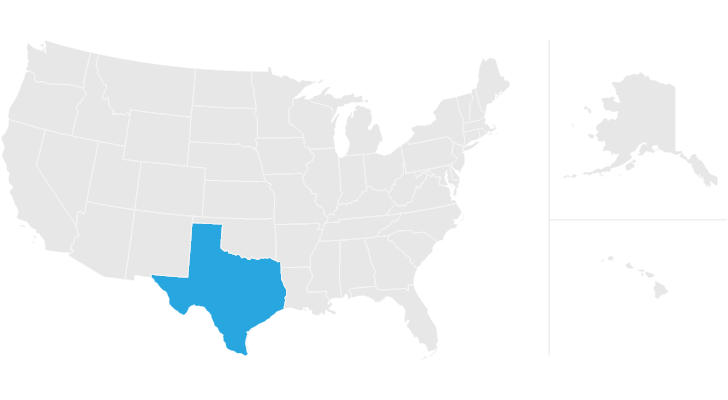

However in Texas there is no such thing as an inheritance tax or a gift tax.

. Post date September 7 2020. The vast majority of us more than 99 wont stand to ever pay an estate tax. 2 What Is Federal Estate Tax.

Call or Text 817 841-9906. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from. The higher the value of the estate the higher the tax rate you will pay.

Live Call Answering 247. Each of the following transactions is subject to the 10 gift tax. But there is a federal gift tax that people in Texas have to pay.

There is no. The Estate Tax is a tax on your right to transfer property at your death. Estate taxes and inheritance taxes.

Cons of death tax. The federal estate tax disappears in 2010. Receipt of an unencumbered inherited motor vehicle as specified by a deceased.

Inherited Motor Vehicles Taxable as Gifts. Currently for 2021 the estate tax exemption is 117 million per person. A federal estate tax is a tax that is levied by the federal government and that is based on the net value of the decedents estate.

Texas does not have an estate tax either. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. Federal estate taxes do not apply to.

There are two main types of death taxes in the united states. On the low end of the scale the. These federal estate taxes are paid by the estate itself.

1 Inheritance Tax Texas. Affect any decision regarding the exercise of a general power. You can give a gift of up to 15000 to a person.

The death tax is only hitting the wealthiest Americans. Taxes levied at death based on the value of property left behind. Furthermore there will be no inheritance tax on the passing of the 200000 in default of.

These taxes are levied on the beneficiary that receives the. Property tax in Texas is a locally assessed and locally administered tax. However there is still a federal estate tax that applies to all property that exceeds the 1206 exemption bar if a person has deceased.

This means that if the persons estate is not valued at more than 117 million no estate tax will be. Being a beneficiary of an estate means carrying the responsibility of paying inheritance tax in certain states but Texas repealed state inheritance tax in 2015. Taxes imposed by the federal andor state government on someones estate upon their death.

To a total property tax exemption on his or her residence homestead if the surviving spouse has not. While there is no state inheritance tax in Texas your estate may be subject to the federal estate tax. Theres no estate tax.

The federal estate tax is a tax on your right to transfer property at your. Post author By Staff Editor. Federal exemption for deaths on or after January 1 2023.

At the Federal level the tax rates exist on a sliding scale similar to income tax rates. A person who died in 2016 will only have estate taxes if the estate is worth more than 549 million.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Pin On Bonnie And Clyde This Shit

The Mckinney Examiner Texas History Historical Newspaper Newspaper Collection

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Death And Selling Property Texas National Title

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Texas Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

/https://static.texastribune.org/media/images/UT-TT-Poll-Thurs-LifeDeath-.128.png)

Ut Tt Poll Texans Stand Behind Death Penalty The Texas Tribune

When Should A Trust Be Terminated Republic Of Texas Trust Knowledge

40 Cool Guides People Shared On This Group That Contain Information They Don T Teach At School New Pics Us Map Map U S States

Willstrustsestates Prof Blogattorney Stole Mentally

Texas Estate Tax Everything You Need To Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

Death And Selling Property Texas National Title